A Symbol of Unity: Celebrating Flag Day

https://youtu.be/PulyBaozgsM National Flag Day, celebrated on June 14th, holds great significance not just in the United States but for many nations around the world. This is a day we come ...

What Does FDIC Stand For and What Does It Do?

FDIC stands for the “Federal Deposit Insurance Corporation” and is an independent government agency. Established in 1933, it provides deposit insurance to depositors in the event of a bank failure. ...

A Brief History of May The 4th

If you’re a Star Wars fan, then you’re well aware of May the 4th. Not an official holiday however, for many Star Wars fans around the world this day is ...

The Importance of Proper Protection

I want to tell you a story about the couple who thought they would save money by opting for low or minimum coverage limits. Meet John and Mary, a young ...

A Message to Siblings

We want to celebrate you! Siblings Day is celebrated on April 10 every year. It was created in 1998 by Claudia Evart, who wanted to honor the special bond between ...

What is March Madness

March Madness is a college basketball tournament that is held every year in March. It is a very popular sporting event in the United States, and it is estimated that ...

Defensible Space

Defensible space is an area around your home that is cleared of flammable materials reducing the risk of wildfire damage. It is important to create defensible space around your home, ...

Fire Season Preparedness In California

As California continues to face annual wildfires it is important to prepare for Fire season. Here are five things you can do to stay safe. Create a space around your ...

What’s an Umbrella Policy?

https://youtu.be/byLDmHn5IRY Personal umbrella insurance is a type of insurance that provides additional liability coverage beyond what your primary insurance policies, such as home or auto insurance, offer. It's designed ...

Workers Compensation Insurance

Workers compensation: A system established under stat law that provides payments, without regard to fault, to employees injured in the course and scope of their employment. Worker's Compensation Insurance: Insurance ...

The Right Coverage

https://www.youtube.com/watch?v=TrLGOqlcpdk Hello again. It's March. And when I get to March, I think about preparing the ground for a garden. Haven't got ready to plant the seeds yet, but I ...

Opposites Attract

Opposites attract is a common phrase that people use to describe how individuals with different personalities can form successful relationships. But why do we often find ourselves attracted to ...

Today’s Leaders

Leadership in the 21st century has evolved significantly from what it was just a few decades ago. Today's leaders must navigate an increasingly complex and interconnected world, where they must ...

A Time To Celebrate

Black History Month, also known as African American History Month, is an annual observance in the United States that highlights the contributions of African Americans to the nation's ...

A VLOG About Love From The Founder

Hear it From Ted February is the month of love. Every February I do one thing for my family. I reevaluate my life insurance. Do I have ...

A Time For Celebration – The Lunar New Year

The Lunar New Year, also known as Chinese New Year, is a significant holiday celebrated by many Asian cultures, including China, Vietnam, and Korea. The celebration marks the start ...

Living Benefits – The New Modern Life Insurance Policy

Living benefits insurance, also known as modern life insurance, is a new type of policy that offers policyholders the ability to access their death benefit while they are still ...

The importance of Homeowners Insurance

January is the perfect time to review your Thome insurance coverage and make sure you have the right amount of protection for your home and belongings. Home insurance is ...

3 Reasons to Review Your Insurance Coverage

January is a time for new beginnings, and what better way to start the year off right than by reviewing your insurance coverage? Here are three reasons why January ...

Preventing Catalytic Converter Theft

What the heck is a catalytic converter and why do people steal them? In short, a catalytic converter is found in your cars exhaust and helps convert environmentally harmful gases ...

How to Jump-Start a Car

When your ride suddenly won’t start from a dead battery, knowing how to use jumper cables is a good skill to have. At first, jump-starting a car can seem like ...

The Art of Mindful Eating

Taking time to be mindful of your eating process and not focusing on restricting calories could enhance your awareness of the experience, improve your relationship with food and help you ...

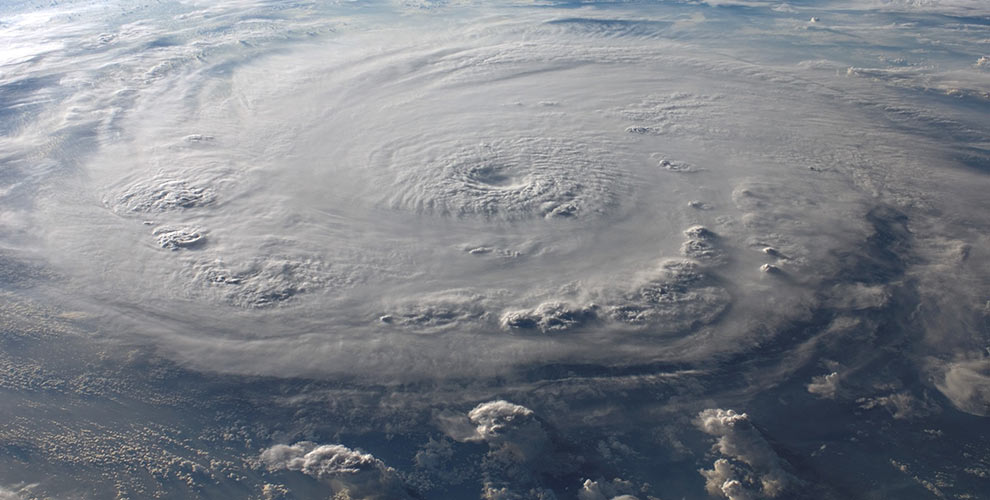

Are You Prepared for a Disaster?

Disasters such as hurricanes, tornadoes, floods and earthquakes can strike with little or no warning. September is National Preparedness Month, making it a good time for you and your household ...

Prevent Home Insurance Claims with Summer Maintenance

Now that summer has arrived, you're probably looking forward to that well-earned vacation. Before you leave, you need to be aware of conditions in and around your home that could ...

California Short Term Rental Insurance

Over the last few years, short term rental (STR) properties have become extremely popular in and around Paso Robles, California. Insuring them has become less costly than when they ...

Figo Pet Insurance

Animal lovers know that our pets are a cherished part of the family. So purchasing insurance on them isn’t a new concept. In fact, the first pet insurance policy was ...

Business Preservation

Welcome to Ted Hamm Insurance Agency video blog! We will be bringing you insights, tips, and risks to look out for pertaining to the insurance industry and hope you are ...

Should My Truck or Car Be Insured on a Business Auto Policy

Do I Need Business Auto Insurance Knowing when to insure your vehicle on a business or personal auto policy can have some major coverage issues if done incorrectly. In fact, ...

Cyber Security When Traveling

Welcome to Ted Hamm Insurance Agency video blog! We will be bringing you insights, tips, and risks to look out for pertaining to the insurance industry and hope you are ...

California Worker’s Compensation Insurance

Workers' compensation insurance is not only a crucial factor when running a business, many times it's required by law, according to the California's Workers' Disability Compensation Act. Not all employers ...

Gap in California Home Policies for Golf Carts

Lets say you purchase a new golf cart to ride around in your neighborhood and perhaps across the street to a local golf course. Did you realize that home insurance ...

Recreational Vehicle Insurance

California Recreational Vehicles Off Premises Whether you enjoy taking a ride on an ATV or seeing the beauty of the US one campground at a time, all recreational vehicles ...

Supreme Court Asked to Resolve Federal Drug Law v. State Medical Marijuana Laws Debate

Supreme Court Asked to Resolve Federal Drug Law v. State Medical Marijuana Laws Debate The U.S. Supreme Court has been asked to address whether the federal drug law that criminalizes ...

Founder’s Blog – Personal Cyber Coverage Explained

Today’s society has grown increasingly digital in nature, with many individuals leveraging smart devices within their daily lives. Although this technology can offer various benefits, it can also make individuals ...

Founder’s Blog – U.S. Eliminates Human Controls Requirement for Fully Automated Vehicles

U.S. regulators issued final rules on Thursday that eliminate the requirement for automated vehicle manufacturers to equip fully autonomous vehicles with manual driving controls in order to meet crash standards. ...

Changes To Your Home That Can Lower Your Home Insurance Rates

Owning a home can be expensive. Not only must you pay your mortgage, water and electricity bills, but you must also pay for insurance on the home. While most of ...

The California Catastrophic Claims Association (MCCA) Refund

California's MCCA has advised that refunds from our Auto Insurance No-Fault Reform Law passed in 2019, are on their way to California auto insurance consumers. Because the changes made by ...

General Liability Claims You May Face Working from Home

Working from home or having a business out of your home has a range of benefits, but it also comes with its own set of dangers. While not having a ...

Auto Insurance Basics – Know Your Coverage

Do you know what's in your auto insurance coverage? This article covers mandatory and optional car insurance so that you can make informed decisions about which ones fit your budget ...

7 Ways To Lower The Cost Of Home Insurance

The price you pay for your homeowner’s insurance can vary by hundreds of dollars, depending on the rates, credits, and endorsements available by your insurance company. Here are some things ...

3 Ways to Save on Business Insurance

This economy has been tough on many businesses, particularly small ones that don’t generate as much income as larger companies. However, insurance is still an important consideration for every business. ...

Review Your Home Insurance For Coverage Limits

Having homeowners insurance on your property is essential to your own security. After all, it helps you both maintain your property and protect your finances in case of hazardous accidents. ...

How Will Home Insurance Cover Your Kitchen Fire

Kitchens are generally the most fire-prone areas of any home. After all, heat is the universal cooking method, and where there’s heat, there is a risk of fire. No kitchen ...

How an Umbrella Protects you From More than Just Rain

With the passage of California’s auto insurance reform now becoming law, the immediate result will be a reduction in MCCA (California Catastrophic Claims Association) fees for all insured drivers. That ...

California Auto Reform Paperwork

Yes, you DID just fill out a bunch of paperwork a few months ago for your auto insurance renewal, and it is time to do it again! When the California ...

What Will Home Insurers See As High Risks?

When determining your home insurance premiums, insurers will gauge how much of a risk you are to invest in. If your chances of filing a claim are much higher than ...

Basic Security Steps For Your Home in 2021

Few things are probably more sacred to you than what lies within the four walls of your home. You go home to feel safe, secure and confident that you will ...

Questions You Should Ask Before Buying Business Insurance

Protecting your business with the right insurance policy is one of your many responsibilities as a business owner and it is crucial to have the best policy. No two businesses ...

The Advantages of Having Life Insurance

Life insurance is a benefit that no family that is concerned for its financial security should do without. It pays a death benefit to your loved ones if you die. ...

Do I Need Business Insurance if I’m Self Employed?

Now more than ever, people are turning to themselves for direction and starting up their own businesses. It can be empowering to be your own boss and adhere to your ...

Business Interruption Insurance Can Help Pay Vendors

An accident in your business might mean that you must temporarily close and therefore lose money. A lack of funds could cause you to miss important financial obligations, including vendor ...

Flood Insurance Becoming A Necessity In California?

We get it – we aren’t a ‘coastal state’, and that is why in California, flood insurance isn’t talked about much; except when required by a Mortgage Company for those ...

How Your Insurance Score Impacts Premiums

We all know that our credit history affects the interest rate we pay for credit cards, home mortgages and auto loans, and that a low credit score can even be ...

Protecting Your California Rental Property

Rental homes have become quite controversial in small towns and communities here in Northern California. Why? Because where one person sees increased traffic, unknown neighbors and events; another sees profit; ...

California No Fault Reform Law: What Does it Mean For You?

Last summer, I wrote about the California No Fault Auto Insurance Reform law right after it had been signed into effect. Since then, insurance agencies throughout the state have ...

Frozen Pipesicles

Yes, that’s not even a word, though it does make you envision a topic we run into often in Northern California — frozen pipes. Does your home insurance cover ...

Who Is An Insured?

The question of ‘who is an insured’ doesn’t seem complicated, until a claim is denied by your insurance company due to their decision that someone is simply ‘not an insured’ ...

Chargeable Accidents

You swerve to miss a deer and end up in the ditch causing damage to your vehicle from the impact; or perhaps you pull off the side of the road ...

Adulting is Hard

Yes, we know that adulting is hard, and that sometimes parents hold on too long and too tight when a child needs to take responsibility and do the ‘adulting’ thing. ...

Replacement Cost vs. Actual Cash Value (New for Old)

You start a load of laundry and head down the road for a neighborhood barbeque. Upon returning, you find water all over your laundry room and into your carpeted hallway. ...

Full Coverage Auto Insurance

One of the most common requests we receive as insurance agents from clients seeking auto insurance, is a quote for ‘full coverage’. What does that even mean? I have been ...

Home Sharing Coverage Issues

I’m still living in my home, so why do you need to know that I’m also renting it out? Unfortunately, this seems to be a common question ‘after’ a claim, ...

California Auto Insurance Reform

The news has been busy recently with photos of Gov. Gretchen Whitmer on Mackinac Island signing into law the long-awaited and strongly controversial auto insurance reform bill that will drastically ...

You Have No Coverage

We understand how upsetting it can be for a client who has paid premiums for years with no claims, to turn one in and hear that it’s simply ‘not covered’ ...

Do I Need To Insure My Bike?

Quiz: Do you know what a Pinarello Bolide, Dogma F8 Xlight, or a Cervelo P5 is? Second Question: Are you aware that they can cost you upwards of $10,000 ...

Understanding Ordinance and Law

What is Ordinance and Law? A frequently misunderstood coverage, ordinance and law is a property coverage issue that can be costly to owners of homes or commercial buildings that suffer ...

When Generations and Families Mix in the Workplace

As a Generation X employer, hiring and mentoring millennials makes for interesting situations; but when that millennial is your son, it makes for an even more unique scenario. I struggled ...

Storms Cause Neighborhood Storms

Once again mother nature caused some issues recently in Northern California with storms and high winds that brought trees down on buildings as well as vehicles. When a tree, regardless ...

Divorce And Division of Property

It happens. Relationships sometimes simply don’t work out, and you find yourself moving out of a home and dividing up assets. The insurance in these situations can be complicated for ...

What does ‘Named Peril’ Mean?

I don’t think anyone would argue that insurance jargon is, at times, very confusing. Even after being in this industry writing insurance policies for over 30 years, I at times ...

California Ranked #6 for Dog Bite Claims

Yes, we know that Fido is an adorable pet that ‘wouldn’t hurt anyone’. However, we also know that insurance companies pay millions of dollars each year for dog bite medical, ...

Factors YOU Control That Impact Your Auto Insurance Costs

Auto insurance rates in California continue to rise due to increasing medical costs. We are the only State with UNLIMITED medical coverage on our auto policies, and as medical costs ...

Shipt Drivers in California

So, I took the plunge! About 3 months ago I decided to give Shipt a whirl and see if it was all the hype that my busy professional mom girlfriends ...

Spring Toys can bring Financial Woes

As the snow leaves us here in Northern California, the trails and mud seem to call riders from all over to get out their ATVs and hit the dirt, sand ...

Claims on Vacant Homes Denied

You and your siblings deal with the excruciating decision to place your mother into a long-term care facility as she can no longer take care of herself due to either ...

Why Do Insurance Costs Vary So Much?

“Imagine the shock of hearing a quote $3,000.00 less than what you are paying for your insurance!” We just received a testimonial from this client who was floored at how ...

Should I Have High Deductibles?

Your home insurance renewal arrives and like most people, you toss it in a drawer or cabinet once you have paid the bill, but you really don't pay much ...

Forms of Auto Collision Coverage in California

California is somewhat unique when it comes to auto insurance in more ways than our Unlimited Medical benefits. When purchasing collision physical damage protection for your vehicles, you have 3 ...

California’s Auto Insurance Reform Defeated

Once again, the attempt to control costs of California Auto Insurance has failed by a 45-63 vote earlier this month. California having the highest auto insurance costs in the nation ...

Does my roommate need Renters Insurance too?

In this day of un-related individuals all living together in a home that just one of them owns, or in an apartment or condo that is leased, renters’ insurance seems ...

How Much Do I Insure My Home For?

You paid $165,000 for your home, but your agent here in California thinks your ‘bargain purchase’ for a seasonal residence should be insured for $208,000. How can that be? We ...

Replacement Cost vs Market Value Issues

You find a major bargain for a rental property in Detroit California and only pay $65,000 for a home, but then after phone calls to 5 different insurance agencies in ...

Claims Reporting – When to Contact Your Agent

You find water in the basement level of your home, or you back your vehicle into your own basketball pole in the driveway; fortunately, your insurance agent is just a ...

Reverse Trick or Treat

[fusion_builder_container hundred_percent="no" equal_height_columns="no" menu_anchor="" hide_on_mobile="small-visibility,medium-visibility,large-visibility" class="" id="" background_color="" background_image="" background_position="center center" background_repeat="no-repeat" fade="no" background_parallax="none" enable_mobile="no" parallax_speed="0.3" video_mp4="" video_webm="" video_ogv="" video_url="" video_aspect_ratio="16:9" video_loop="yes" video_mute="yes" video_preview_image="" border_size="" border_color="" border_style="solid" margin_top="" margin_bottom="" padding_top="" ...

Uber & Lyft have arrived in Traverse City

So, to answer the big insurance question – it’s a flat NO – your standard California auto insurance policy does NOT cover you while you are being a local ...

California Auto – Medical Order of Priority

California is often in the news about our auto insurance being the highest in the Nation. Truth! Why? – Because California is the ONLY State that provides UNLIMITED medical coverage ...

Salvage Autos – Hurricanes, Floods, Collisions

We realize that Northern California isn’t home to many floods or hurricanes, but we find when major storms occur like Hurricane Harvey, Californiaders end up with vehicles that come from ...

What Californiaders can learn from Hurricane Harvey

Our hearts go out to the victims of Hurricane Harvey, especially knowing that 85% of them have no flood insurance. These people face a crushing blow to their personal finances ...

You wrecked “Brad” and you want a new “Brad”

Yes, we realize that the Liberty Mutual television ad about wrecking a just purchased vehicle (she calls Brad), and not being able to purchase another one with the insurance proceeds, ...

College Kids – To Be… or Not to Be… On Their Own

Your 19-year-old son is away at college, is listed as a ‘driver’ on your auto policy and is using a vehicle that you; their parent – owns and insures. ...

Teen Driver Safety Tips

Drivers education courses provide our teens with enough knowledge and hands on experience to get their license, but that’s about it. I realized this as I watched my 16-year-old taking ...

Renters Insurance – Worth the cost of 2 Ristretto Venti Chocolate Brownie Iced Drinks?

Not only are kids moving back into their parents’ homes, now they are bringing their significant other and many times, other unrelated minor children with them. Today’s home can have ...

Client Relationships

Today I got the news that a long term client of mine passed away over the weekend. Every business owner gets these calls, and we empathize over the phone with ...

Why is Local Important?

Yes Amazon is quick, convenient, and all too easy to use. My 16-year-old doesn’t understand why I prefer to purchase what I can here locally in Traverse City. Just today ...

Cover Yourself with an Umbrella

An Umbrella Liability policy is a ‘separate’ policy that provides clients with an additional ‘layer’ of liability protection. The policy is placed ‘on top of’ your other insurance policies; hence ...

Home Insurance – Use Your 15 Minutes Wisely

15 Minutes can save you money now, but cost you thousands later. Oh wait, they don’t tell you that. The price gun, the lizard, the mayhem guy. We all have seen ...

How I found passion in – of all things – an insurance career

In 1988 with just a high school diploma for credentials, I answered a newspaper ad for a receptionist at a local insurance agency. My long term goal: To work with ...